This is a welcome step toward controlling legal costs, coming as it does on the back of increases to the guideline hourly rates.

As confirmed last week the Government plans to resurrect Sir Rupert Jackson’s proposals from 2017 to extend the fixed recoverable costs (FRC) regime. This is a welcome step toward controlling legal costs, coming as it does on the back of increases to the guideline hourly rates.

The original proposals found favour with the Government and the MOJ consulted on those proposals in 2019. The MOJ were then slow to act following that consultation and were then hindered by the Covid-19 pandemic. However, last week they published their response to the consultation and indicated their intention to press ahead with implementation.

Scope

The proposals are to extend fixed costs across the fast track and across most money claims with a value of up to £100,000. Notable exceptions for the insurance sector are claims involving oral evidence of more than 2 experts per party and where the trial is likely to exceed 3 days. Mesothelioma and other asbestos related lung disease claims, clinical negligence cases, actions against the police, child sexual abuse claims & Intellectual property cases are also excluded.

The new FRC will be introduced for claims in which the cause of action arises on or after the implementation date (or, in disease claims, if no letter of claim has been sent prior to implementation).

FRC in the fast track

FRC were introduced in fast track for personal claims in 2013 and their implementation is generally considered to have been successful in terms of controlling legal costs. The extension across the fast track will provide some much-needed control, particularly for the like of credit hire claims.

Fast track credit hire has been an area in desperate need of fixed costs and with confirmation that credit hire claims will fall within the lowest complexity band of the new structure, we may now at last see costs in low value credit hire claims coming under much needed control.

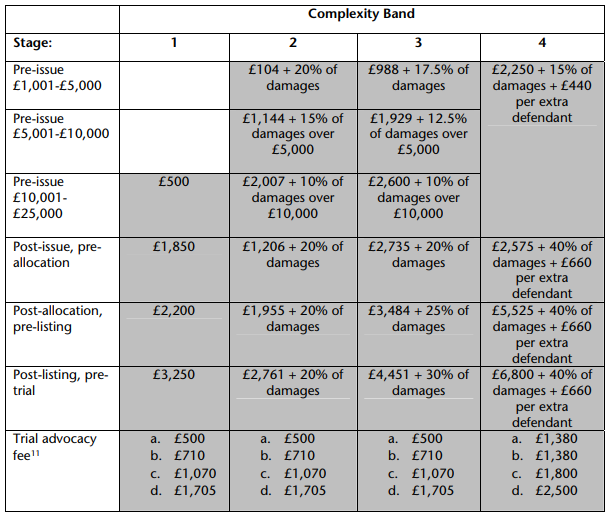

The table below outlines the structure of the fixed costs on the fast track. It has been confirmed that the figures will be uplifted to account for inflation.

Extension of the fast track (intermediate cases)

Whilst Sir Rupert Jackson had proposed the creation of an intermediate track for cases valued between £25,000 and £100,000 the Government has decided instead to simply extend the fast track.

That is likely to have a significant impact on the tactical approach on each side of the litigation divide given the restrictions likely to be imposed on the evidence allowed. Like for like medical evidence has been commonplace in low value multi-track claims. Such an approach may no longer be tolerated. Only time will tell whether the courts approach to these cases differs from its approach to the traditional fast track case.

The four-band structure

The new FRC regime will involve a four-band structure, band 1 being for the simplest cases and band 4 for the most complex. Allocation to a band will either be by agreement or by judicial decision based on the parties’ directions questionnaires and the claim form. The parties will be able to challenge the banding at a case management conference, but an unsuccessful challenge will come with a costs liability of £150 in the fast track and £300 for intermediate cases.

Limited guidance has been provided to date, and despite both sides of the litigation divide requesting more guidance on the banding of cases, the Government has refused to provide much further saying “it is for the parties and judges to come to sensible conclusions on banding in light of the criteria set”. Given the financial benefits to be had from moving a case or group of cases up or down a band, satellite litigation in this area is inevitable. For example, a jump from band 1 to band 2 will see the recoverable costs more than double.

The original proposals do suggest that most personal claims with a single live issue (quantum for example) will fall into band 1 but those involving two live issues (liability and quantum for example) will fall into band 2. Defendants will therefore need to give very careful consideration to the approach adopted to liability, contributory negligence and causation in cases where any saving in damages could be exceeded by additional costs liabilities.

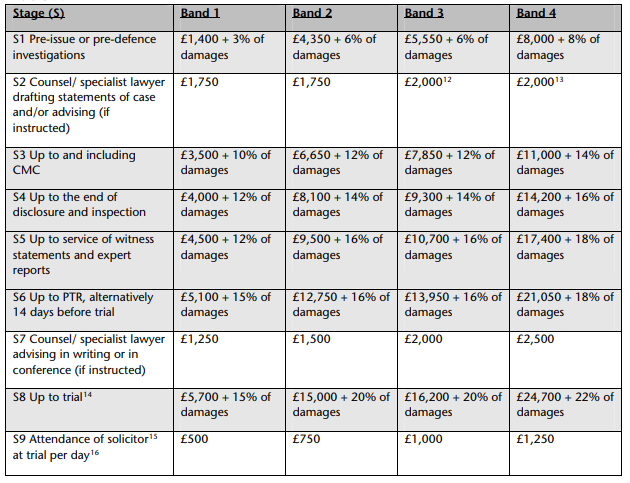

The table below outlines the structure of the fixed costs for intermediate cases. It has been confirmed that the figures will be uplifted to account for inflation.

Uplifts and escape

It has been confirmed that, where a party beats their own Part 36 offer and would have been entitled to indemnity costs, the party will now be entitled to a 35% uplift on the fixed costs sums. This will apply to the stage during which and those after the relevant period under a Part 36 offer expires.

There is also a 50% uplift to be applied on account of unreasonable conduct in the litigation. Again, there will inevitably be satellite litigation as to what constitutes unreasonable conduct. At present there is no suggestion that unreasonable behaviour by the Claimant will result in a 50% reduction to the FRC. Therefore, we will have to wait until the rules are published before we know the extent to which the rules will provide parity for both parties in so far as unreasonable behaviour is concerned.

In claims arising from the same set of facts there will be a 25% uplift for each additional claimant. It will be interesting to see how claimant law firms respond to this, but one possibility is reciprocal arrangements where different firms act for each claimant in order to maximise costs recovery.

The existing ‘exceptional circumstances’ escape clause will also be implemented. As confirmed by the High Court in HF’s own case of Ferri v Gill [2019] EWHC 952 this is a high hurdle and in practice very few claims meet the threshold. We expect the same to be the case with the new FRC regime.

Next steps

The MOJ has confirmed that they will now begin working with the Civil Procedure Rules Committee on implementation. The devil will very much be in the detail given that it is unclear how a number of the proposals will work in practice.

Whilst no timeframe has been provided, there is a significant amount of work required and the general expectation is that the earliest likely implementation date will be Autumn 2022.

This article provides a summary of the key changes, keep your eyes peeled for our next piece, outlining what we consider likely to be the key battle grounds under the new regime!

Publication Author:

Paul McCarthy

Partner & Head of Costs

You may also like

HF’s Counter-Fraud & Costs Teams save over £64k for Admiral

The true value of cross-departmental collaboration was showcased by HF in a recent claim, saving Admiral over £64,000. Following a...

Update to Ireland’s Occupiers’ Liability Law

For almost 30 years, the Occupiers’ Liability Act, 1995 (“the 1995 Act”) has represented the settled statutory position in Ireland...

Draft Rules for the FRC Extension have now been published

The Civil Procedure Rule Committee has now published drafts of the amended Civil Procedure Rules to implement the extension of...

Housing Disrepair Claims Insulated for Another Two Years

Despite the suggestion in 2022 that housing cases may be part of the extension to fixed recoverable costs (FRC) regime,...