This could represent a missed opportunity, as one proposal within the Bill was of particular interest to the insurance and claims community; the plan to increase the financial penalties for those pestering people with nuisance calls and text messages.

When our newly crowned King delivered the 2022 Queen’s Speech on her behalf in May, the announcement of the Data Reform Bill (now known as the Data Protection and Digital Information Bill) was first notice of the government’s intention at that time to depart significantly from the adopted EU regulation, UK GDPR.

A lot has happened since that proposal, including the appointment of Liz Truss as our new Prime Minister and the Bill’s primary sponsor Nadine Dorries resigning from her post as the minster for Department for Digital, Culture, Media and Sport.

Those changes may have been the reason that a scheduled parliamentary debate on the legislative proposals was postponed recently and there are now some reservations as to whether it will be taken forward at all in its current form.

This could represent a missed opportunity, as one proposal within the Bill was of particular interest to the insurance and claims community; the plan to increase the financial penalties for those pestering people with nuisance calls and text messages.

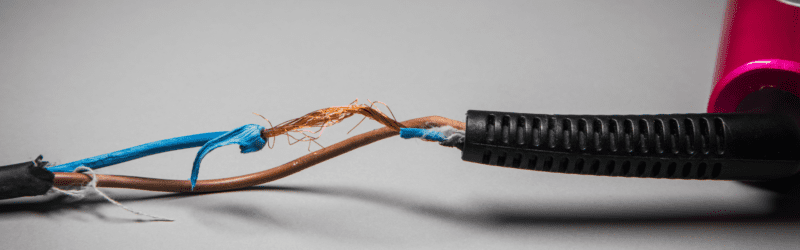

Although technology has more recently enabled some ‘claims farmers’ to capture prospective clients by new mediums (such as paid online advertising), the statistics suggest that unsolicited telephone contact a.k.a. ‘cold calls and texts’ are still prevalent. For many of us, nuisance calls are simply an irritating and annoying interruption to our daily lives, but for some, chiefly the most vulnerable in society, they can cause serious anxiety and distress.

The new fines proposed would increase from the current maximum of £500,000 and be brought in line with UK GDPR penalties which are up to four per of cent global turnover or £17.5 million, whichever is greater. The hope being that a 35-fold increase in the maximum penalty will deter those engaging in this unwelcome activity.

The number of complaints to the Information Commissioner’s Office regarding nuisance calls in accident claims has remained steady for over a year, albeit prior to that there was a significant increase coinciding with the changes in whiplash legislation at the time. In total, complaints regarding nuisance calls and texts across the board topped 130,000 in the last year alone.

So, would the proposed changes make a difference? There is reasonably clear evidence that previous legislative and regulative attempts to curb this behaviour had only partial success.

The new proposals would certainly be a further tool in the armoury available to regulators, but there are some obvious gaps which need filling. Whilst the location of claims call centres in the UK (mainly in the Northwest of England) would be subject to the new fines, a significant number of calls are known to have come from call centres outside the UK, indeed outside of Europe entirely, thus would be outside of the reach of the new legislation.

In our view, only the telecom networks have the ability to track, trace and disrupt these organisations. In an ideal world they would be able share data, intelligence and take remedial action, but the logistical difficulties involved in doing so perhaps prohibit this.

At HF, we have been a leading proponent in tackling ‘farmed’ and cold called claims for over a decade, developing bespoke strategies for each individual opponent and introducing innovative solutions to tackle the issues, such as our multiple award-winning HOLT product.

You may also like

What will 2023 bring for open-source Intelligence investigations?

As technology continues to advance and evolve, it is likely that we will see developments in the field of open-source...

Expert engineering evidence – the defendant lawyer’s perspective

Published and featured in ‘The Assessor’ When a client says, “I’ve got this great case, but it’s going to need...

Positive news in the battle against spoof advertising

In welcome news for the industry, the government has bowed to the insurer lobby to the effect that social media...

Data Breach and Privacy Claims – The next big thing?

Following the introduction of holiday sickness claims protocols and fixed fees (April 2019), the PPI claim limitation deadline (August 2019)...